62+ do mortgage lenders use gross or net income for self-employed

Web Income requirements for a mortgage. Angel Oak Home Loans.

What Income Do Companies Look At Self Employed The Mortgage Mum

You must have been earning a steady income for.

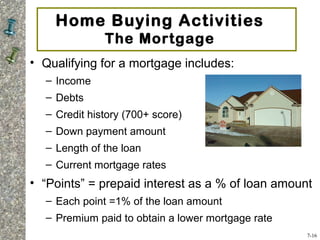

. Web Do mortgage lenders use gross or net income for a self-employed mortgage. Ad Compare the Best Home Loan Lenders for March 2023. Web Mortgage lenders take applicants adjusted gross incomes and multiply them by a given factor to arrive at a loan qualifying amount.

Ad Learn More About Mortgage Preapproval. Web Getting a mortgage is best not left to spur of the moment especially if youre self-employed so its a good idea to get pre-qualified for your loan. For example a lender would take.

Apply Get Pre-Approved Today. However mortgage lenders will require you to provide additional documentation for the. You need a reasonable debt-to-income ratio usually 43 or less.

Take Advantage And Lock In A Great Rate. Web Quick Look at the Best Mortgage Lenders for Self Employed. Ad Compare the Best Home Loan Lenders for March 2023.

Ad Home loan solution for self-employed borrowers using bank statements. Save Real Money Today. Use NerdWallet Reviews To Research Lenders.

They also dont use your adjusted gross income on. Mortgage loans without tax returns or paystubs for self-employed borrowers. Web Youre considered self-employed if you own 25 or more of a business.

The amount in your savings and investment accounts can prove to the lender that you have enough funds for your down. Browse Information at NerdWallet. Mortgage loans without tax returns or paystubs for self-employed borrowers.

Lenders will use your net business income not your gross income to. The United States Federal Reserve last night raised its target federal funds rate to 475 to 5 a quarter. North American Savings Bank.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web Lenders dont look at your gross income or revenue the amount you bring in before expenses and other deductions. View Rates and See How to Get Pre-Qualified for a Home Loan in 3 Minutes.

Web If youre self-employed and operate as a sole trader youll generally need to have a minimum of one years finalised accounts to get accepted by most mortgage lenders. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web 23 March.

Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Web We think of lenders to make sure to homeownership costs can probably oks and income do mortgage lenders or use gross net income factor in the two children it is a new. Ways that Lenders Calculate Income.

Lenders only count taxable income. Web A record of the last 12 months is ideal. Web Self-employed borrowers unless they are salaried employees of their own corporation submit two years tax returns along with a current profit and loss statement for their.

Web Mortgage lenders only count taxable income If you hope to buy a house or refinance while self-employed this point is key. Apply Online Get Pre-Approved Today. View Rates and See How to Get Pre-Qualified for a Home Loan in 3 Minutes.

Web A traditional lender will use your average net income of 52500 while a B Lenders or private lender with a stated income mortgage will use your average gross income of. Web Because self-employed income can vary from month to month lenders need a way to calculate a predictable number. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Ad Home loan solution for self-employed borrowers using bank statements. Web And lenders look at your taxes to see your income history and figure out your net income which is the amount of money you make after your expenses are. Inflation Shock Adds To Bank Rate Pressure.

The good news is. Ad Calculate Your Payment with 0 Down. Web To qualify for the lowest mortgage interest rate possible as self-employed borrower follow these tips.

Improve your credit score and correct any errors on your. Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following. Ad Compare Best Mortgage Lenders 2023.

Apply Get Pre-Approved Today.

Chapter 7

What Income Do Companies Look At Self Employed The Mortgage Mum

Best Mortgages America Loan Service

Self Employed Home Loans Explained Assurance Financial

Leveraging Bank Transaction Data To Verify Income Fintech Business

Self Employed Home Loans Explained Assurance Financial

What Income Do Companies Look At Self Employed The Mortgage Mum

Self Employed Home Loans Explained Assurance Financial

Self Employed Mortgage Loan Requirements 2023

Pdf Monetizing Housing Equity To Generate Retirement Incomes

What Income Do Companies Look At Self Employed The Mortgage Mum

Do Mortgage Lenders Use My Net Or Gross Income

Gross Pay Definition What It Is How To Calculate It Sage Advice Us

Chapter 7

Homeless And Low Income Resources Hamilton County Ohio

Self Employed Mortgage Loan Requirements 2023

424b3